What is a budgeting tool?

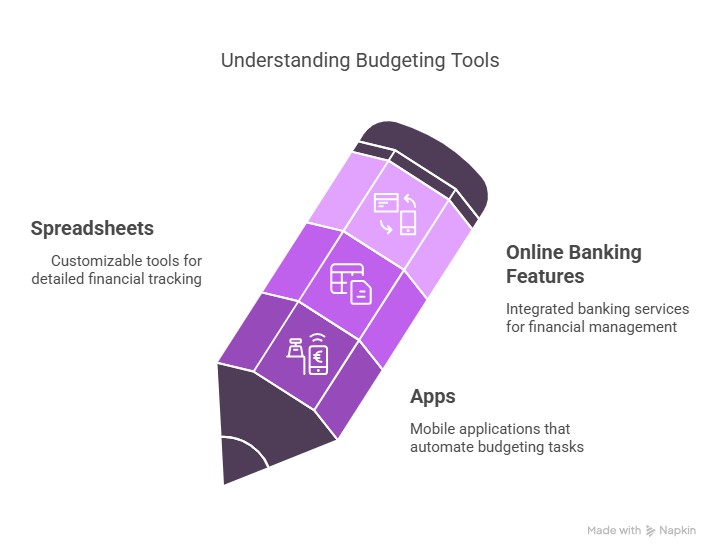

It’s a financial resource designed to help individuals track income, manage expenses, and make informed money decisions. Budgeting tools come in various forms, like apps, spreadsheets, or online banking features. Apps often sync with bank accounts, categorize spending, and send alerts, making budgeting easier and more automated. Spreadsheets, like those in Excel or Google Sheets, allow for full customization and control. Each option has its own benefits depending on your needs and comfort with technology. What is a budgeting tool? Simply put, it’s your personal assistant for managing money and staying on top of your financial goals

What are the best tips for budgeting?

1. Identify Areas Where You Can Cut Costs

Start by reviewing your spending habits. Separate your expenses into “essentials” (like rent and groceries) and “non-essentials” (like dining out or subscriptions). Look for areas where you’re overspending and set goals to reduce it. Cancel unused services, switch to cheaper options, or negotiate bills when possible.

2. Plan for Occasional and Emergency Expenses

Some expenses don’t happen every month—like gifts, travel, or seasonal items. Budget a small amount monthly for these. Also, build an emergency fund that covers 3–6 months of living costs to protect yourself from unexpected events like job loss or medical bills.

3. Focus on Long-Term Financial Goals

Think about your future: Do you want to buy a house, retire early, or pay for your child’s education? Set clear financial goals and align your budget to support them. Reassess these goals regularly as your life situation changes.

4. Be Realistic and Flexible

Don’t make a budget so tight that it feels impossible to follow. Allow for small impulse buys and adjust your budget if your income or expenses change. Flexibility keeps you motivated and helps you avoid feeling restricted.

5. Stay Consistent

Budgeting isn’t a one-time task—it’s a habit. Track your spending regularly and update your budget every month. Checking your bank history often will help you stay aware of where your money is going and make better decisions.

6. Use Budgeting Tools and Apps

Technology can make budgeting easier. Use apps that link to your bank to automatically track spending and set alerts. If you prefer manual tracking, spreadsheets are great for customizing your budget. Online banking also offers helpful tracking features.

7. Communicate About Money

If you’re socializing with friends who spend beyond your budget, be honest. Suggest fun, affordable alternatives that suit your financial plan. Open conversations can help you stay committed without feeling left out.

Simple Monthly Budget Table

| Category | Budgeted Amount | Actual Spending | Notes/Examples |

| Income | ₹50,000 | ₹50,000 | Monthly salary or business income |

Fixed Expenses

| Rent | Rent₹10,000 | Rent₹10,000 | Fixed monthly apartment rent |

| Internet & Utilities | ₹2,000 | ₹18,00 | Electricity, water, Wi-Fi |

| Insurance | ₹1,500 | ₹1,500 | Health or vehicle insurance |

Variable Expenses

| Groceries | ₹6,000 | ₹6,500 | Slightly overspent on food |

| Transportation | ₹3,000 | ₹2,800 | Fuel, bus, metro |

| Eating Out | ₹2,000 | ₹2,500 | Reduce this next month |

| Entertainment | ₹1,000 | ₹8,00 | Movies, subscriptions |

Savings & Goals

| Emergency Fund | ₹5,000 | ₹5,000 | Saving for unexpected expenses |

| Investment (SIP/Mutual) | ₹5,000 | ₹5,000 | Long-term wealth building |

| Vacation Fund | ₹2,000 | ₹2,000 | Saving for upcoming trip |

| Total Expenses | ₹38,500 | ₹37,900 | Keep some cushion for any change |

| Surplus/Leftover | ₹11,500 | ₹12,100 | Can be carried forward or added to savings |

What are 3 tools for creating a budget?

1. Budgeting Apps

Budgeting apps are popular digital tools that automate the tracking of your expenses and income. They sync with your bank accounts to give you a comprehensive view of your finances. Features include categorizing spending, sending alerts, setting financial goals, and generating reports. Some apps also include bill reminders, savings goals, and debt tracking. While many apps offer free versions, advanced features often require a subscription. Popular apps include Mint, YNAB (You Need a Budget), PocketGuard, GoodBudget, Wally, and Personal Capital.

Recently i am using these tool GoodBudget,it’s not a recommendation

2. Spreadsheets or Worksheets

Spreadsheets, like Microsoft Excel or Google Sheets, are a traditional yet highly customizable budgeting tool. They allow for the creation of tailored budgets and detailed data analysis using formulas. Spreadsheets are free to use but require manual data entry, which can be time-consuming and may lead to errors. Pre-designed templates are also available to help you get started.

Download for free spreadsheet-Click here

3. Online Banking

Though not a dedicated budgeting tool, online banking is an essential resource for tracking your spending. It provides up-to-date insights into your finances and helps you keep track of how much you’re spending in real time. Regularly checking your bank account history via online banking can prevent surprises and keep you aware of your financial status.

What is the 60 20 20 Budget? A Simple Way to Manage Your Money

If you’ve ever wondered what is the 60 20 20 budget?, it’s a straightforward and flexible money management method that helps you balance your financial needs, goals, and lifestyle. Here’s how it works:

60% for Living Expenses

This chunk of your income covers your essential bills—rent, groceries, utilities, insurance, and transport. Think of this as the money that keeps your life running smoothly. If you’re spending more than 60% here, it might be time to review your expenses or look for ways to boost your income.

20% for Savings and Debt Repayment

Next, set aside 20% for building financial security. Start by creating an emergency fund (Scott Pape calls it a “Mojo account”) with at least ₹2,000. After that, focus on paying off your smallest debts first and steadily build your savings.

20% for Your Entertainment

This is the fun money! Use it for entertainment, hobbies, travel, or anything that brings you joy. The beauty of this system is that it allows guilt-free spending—because your essentials and savings are already covered.

Compared to the more common 50/30/20 method, the 60/20/20 split gives you more room for essentials and savings, making it ideal for people in high-cost areas or those with focused savings goals.

How to Apply the 60/20/20 Budget Rule:

- Calculate Your Monthly Take-Home Income

This is the amount you receive after taxes and deductions (e.g., ₹50,000/month). - Divide Your Income Using the 60/20/20 Formula60% for essential Living Expenses

20% for Savings/Debt Repayment

20% for personal Splurges/Discretionary Spending - Assign Your Expenses Accordingly

Categorize your actual expenses into the three buckets and adjust where needed.

Example: 60/20/20 Budget for ₹50,000 Monthly Income

| Category | % of Income | Amount (₹) | Example Expenses |

| Living Expenses | 60% | ₹30,000 | Rent, groceries, electricity, transport, insurance |

| Savings/Debt | 20% | ₹10,000 | Emergency fund, SIPs, loan repayment, savings goals |

| Splurges | 20% | ₹10,000 | Dining out, movies, shopping, vacation, hobbies |

Conclusion

Budgeting is essential for achieving financial goals and avoiding unnecessary stress. Using budgeting tips and tools, such as apps, spreadsheets, and banking platforms, can help you make informed money decisions. From understanding what is a budgeting tool to learning what is the 60 20 20 budget, this guide offers practical advice for better money management. Start small, stay consistent, and adjust your plan as life evolves—your future self will thank you.

1: What is the easiest budgeting method for beginners?

The 50/30/20 rule is one of the easiest methods for beginners. You divide your after-tax income into 50% for needs, 30% for wants, and 20% for savings or debt repayment. It’s simple to follow and doesn’t require complicated tools—perfect for those just starting out with budgeting.

2: How often should I update my budget?

Ideally, you should review and update your budget once a month. This helps you adjust for any changes in income, unexpected expenses, or new financial goals. Weekly check-ins can also help you stay on track with spending.

3: Can I use both a budgeting app and a spreadsheet?

Yes! Many people use a hybrid approach. Apps are great for real-time tracking and alerts, while spreadsheets allow for deeper analysis and customization. Using both gives you the best of automation and control.

Leave a Reply